Executive Summary

Cook Protocol establishes a transparent and flexible asset management platform

suited to diverse investors and asset management service providers alike. Investors

can monitor a manager’s fund allocations without worrying about fund security or foul

play. At the same time, fund managers can leverage Cook Protocol to gain access to

investors and carry out virtually any investment strategy without having to opensource the strategy.

Mission & Vision

Cook Protocol was founded on the belief that everyone needs to have access to

finance. We contend that decentralization holds the key to empowering people

around the world to better manage their assets, and we are helping the world move

in this direction by accelerating the transition to adopting decentralized finance.

Mission:

Accelerate Adoption of Open and Decentralized Finance.

We believe that we can accelerate the adoption of decentralized finance by:

Providing investors with secure, transparent and high-quality asset management

services.

Providing fund managers with funds and a variety of asset management tools

Vision:

Bring Finance to the Masses

In our journey towards achieving this vision, we are:

Democratizing secure, transparent and high-quality financial services with a

lasting, positive impact.

Becoming a world-leading decentralized asset management platform

Problems

Traditional asset management markets are opaque in revenue, profit, and risk

information. They are usually limited to wealthy private and institutional clients due to

inherent structural inefficiencies and hefty fee structures. Blockchain-based wealth

management provides a promising alternative because of the open and transparent

nature of blockchain technology.

However, existing blockchain solutions are often too sophisticated and technically

obscure for ordinary investors. Moreover, none of them provides the necessary

investment tools for professional fund managers to flexibly carry out a variety of

strategies.

Solutions

To tackle the aforementioned challenges, we are creating an Ethereum-based

decentralized asset management platform to provide ordinary investors with

professional asset management services. The platform offers the following benefits:

Investors can access high-quality asset management services without

professional knowledge of decentralized finance (DeFi). They only need to

select the appropriate investment strategies and send cryptocurrencies to the

corresponding smart contract to obtain ckTokens (fund-specific LP tokens).

They can sell or redeem ckTokens at any time.

Fund managers can create funds, configure investment strategies to attract

investors, and use tools on the platform to execute investment strategies.

Smart contracts guarantee security of the funds and transparency of the

underlying assets by limiting the access of fund managers.

Decentralized Autonomous Organization and Tokenomics incentivize global

investors and fund managers to interact with each other via smart contracts

deployed on Cook Protocol.

Passive investors interested in index-based investing strategies desire a selection of

high-level low-fee funds that track the growth of an index or industry. Investors with

higher risk-tolerance who seek higher returns require professional fund managers

who will bring extensive experience and advanced trading techniques to the table.

Cook Protocol aims to become a platform that matches a wide range of investors’

and fund managers’ needs while remaining trustless and transparent.

COOK Token

Token Allocation

10 billion COOK tokens will be minted at genesis. The token allocation is as follows:

60% to the COOK community treasury with a six-year vesting schedule.

6,000,000,000 COOK

10% to community incentive & Airdrop. 1,000,000,000 COOK

10% to early community investors with a price-based and time-based

unlocking schedule. 1,000,000,000 COOK

10% to business and media partners. 1,000,000,000 COOK

10% to team members, advisors and future employees with a price-based

unlocking schedule after 90 days cliff. 1,000,000,000 COOK.

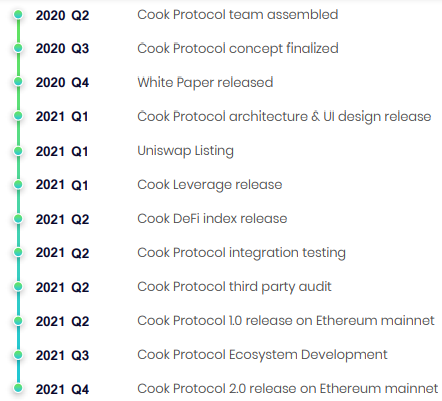

Roadmap

TEAM

Adrian Peng, Chief Executive Officer

Cage Chen, Chief Technology Officer

Michael Bader, Chief Financial Officer

Ace Yin, Chief Operating Officer

Matias Dominguez, Chief Marketing Officer

Antonio Wong, VP of Blockchain Development

Rahul Rodrigues, Chief Architect

For more information:

WEBSITE: https://www.cook.finance/?utm_source=bitcointalk&utm_medium=bounty&utm_campaign=bounty_phase_1

WHITEPAPER: https://www.cook.finance/whitepaper/?utm_source=bitcointalk&utm_medium=bounty&utm_campaign=bounty_phase_1

TELEGRAM: https://t.me/cook_english

TWITTER: https://twitter.com/cook_finance

LINKEDIN: https://www.linkedin.com/company/cook-finanace/

REDDIT: https://www.reddit.com/r/CookProtocol/

YOUTUBE: https://www.youtube.com/channel/UCGiAQqspfq9LE0XgFlywN7w/

AUTHOR:

sultan1984

https://bitcointalk.org/index.php?action=profile;u=2053255

ETH: 0xe0D843e18Df2861E8c3Aa74F51b0FA2EFE1b63c8

No comments:

Post a Comment