There are two opposing goals for the value of the DataGrid Token (DGT):

The first is the desire to create a usable currency. For this, it needs to be stable and related to externalities, such as national economies reflected in currency exchange rates. If the DGT is stable it can see adoption for use as a means of commerce for a decentralized global economy.

The second is the desire for the DGT to gain in value against other currencies so we can exchange some of it (i.e. USD or EUR) during an initial phase. That is, the DGT should have a lower inflation rate than other currencies during an initial phase, and a negative internal price inflation rate.

To accomplish either of these goals a means of currency supply management of the DGT is needed.

Existing cryptocurrency supply management approaches consist of three solutions:

Incentive rewards for performing the block mining algorithm (i.e. proof-of-work). The amount of reward per block received diminishes over time, eventually reducing to zero. This is the Bitcoin model. Eventually, all of the Bitcoin tokens[1] that will ever exist will be mined. The token supply is fixed in the longterm.

Similarly, incentive rewards for performing the block mining algorithm, except the amount of reward per block is fixed and never diminishes. In this case, the token supply increases forever. However, the percentage of increase per incentive reward as related to the total token continuously decays.

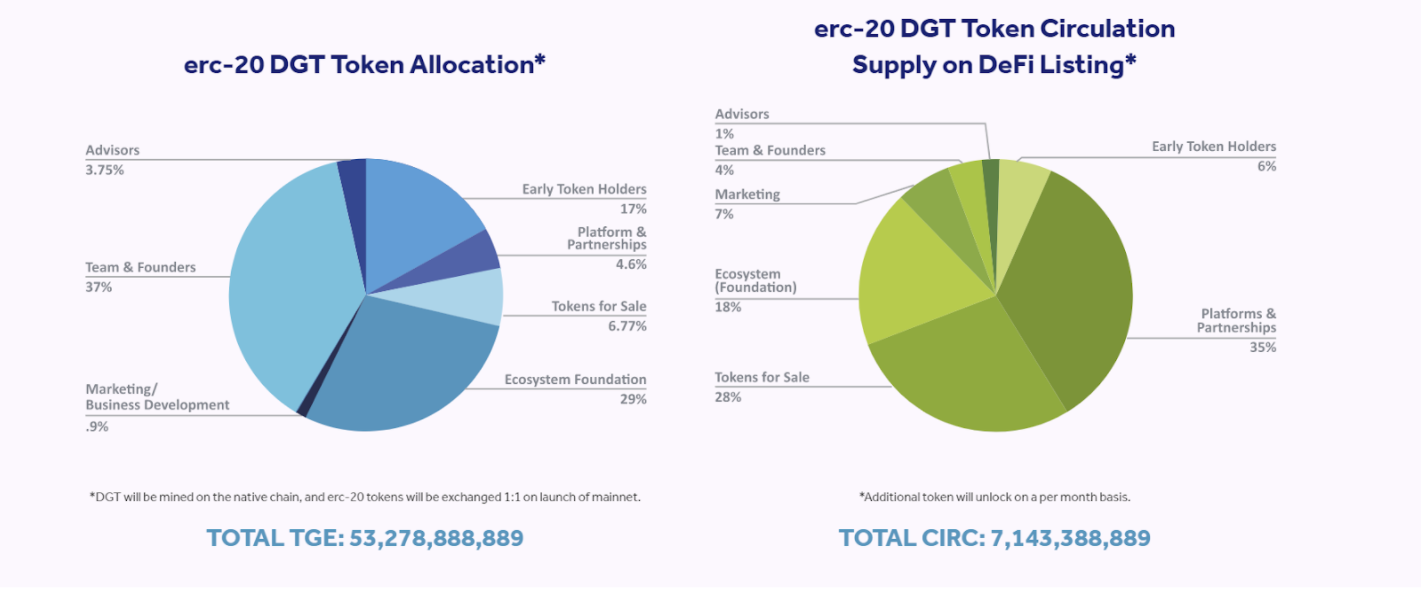

A token generation event (TGE), which creates a fixed supply of tokens. These tokens are then distributed to accounts via some mechanism (i.e. “airdrops). Although theoretically there can be multiple TGE’s for a given token, in general such designs, envision a single TGE, or at most predetermined periodic TGE’s.

In summary 2 out of the 3 solutions are essentially a fixed supply of tokens, and the 3rd ‘s rate of change of the token supply drops to negligible amounts over time, thus effectively making it also a fixed supply. In short, currency supply management does not exist in the blockchain and cryptocurrency implementations.

Managing the DataGrid Token Supply for Value Accumulation and Currency Usability:

So, the question and challenge are how to come up with a mix that satisfies short term ROI for us early investors and early adopters, while making sure in the long run that the DGT stabilizes and becomes a general, usable, currency.

The answer is that the money supply inflation initially must be less than the digital GDP growth, which will cause DGT deflation and thus accumulation in value, then allow for some sort of price stabilization, and adjust money supply against digital GDP resulting in longer term DGT price stability and usability as a general currency.

Now, the question is, how to come up with a mix that satisfies short term value accumulation and thus an ROI for us, early investors and early adopters, while making sure in the long run that the DGT stabilizes.

The way to do this is to combine the experience of both the cryptocurrency models and the national economy models.

The cryptocurrency models, typified by the Bitcoin model for initial coin incentive rewards give us the deflationary model and the value accumulation and ROI desired, but add a second term in DGT supply management equation that inflates and/or deflates for digital GDP which is initially has no weighting in the supply management decision, but becomes heavier weighted over time, eventually completely dominating the supply management decision.

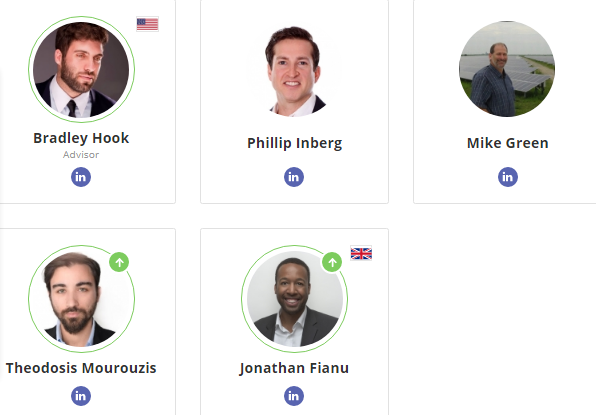

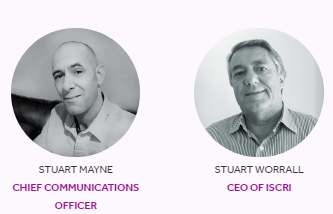

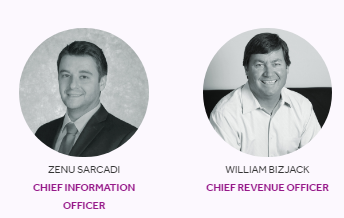

Team

FOR MORE INFORMATION CENTER:

WEBSITE: https://www.prasaga.com/

WHITEPAPER: https://www.prasaga.com/ecosystem-whitepaper/

TWITTER: https://twitter.com/PrasagaOfficial

TELEGRAM: https://t.me/prasagaofficial

FACEBOOK: https://www.facebook.com/prasagaofficial

LINKEDIN: https://www.linkedin.com/company/prasaga/

AUTHOR:

sultan1984

https://bitcointalk.org/index.php?action=profile;u=2053255

TELEGRAM: @Tacil78

ETH: 0xe0D843e18Df2861E8c3Aa74F51b0FA2EFE1b63c8